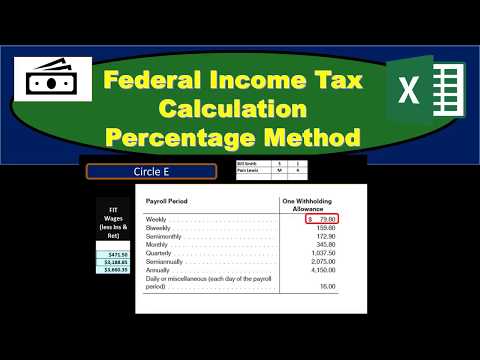

In this presentation, we will calculate federal income tax using the percentage method. For more accounting information and accounting courses, visit our website at accountinginstruction.info. Currently, we have our payroll register here, where we're focusing on Pam, who is the higher earner. Therefore, she will need to be calculated with the percentage method instead of just using the tables. She will be married with allowances and her salary pay is $3,653 on a weekly basis, which will be her total earnings. Our focus is on the FIT calculation, so we need to know what the FIT wages are, which may differ from the total wages. The total earnings will be reduced by deductions such as a cafeteria plan or retirement plan like a 401k, which we can designate as $280 and $185 respectively. Therefore, the FIT earnings will be $3,188.85. We are primarily focusing on Pam's wages for the FIT calculation. To access the most current tables, we need to visit the IRS website, irs.gov, and search for the Circular E. The Circular E provides tables for calculating payroll withholdings, but since Pam's wages are higher, we will need to use the percentage method instead. This method allows us to understand the progressive tax system and the complexity of calculating taxes. To begin, we need to refer to the table on the Circular E to determine the allowance for the pay period we are using, which is currently weekly.

Award-winning PDF software

How to file 945 online Form: What You Should Know

See more information on When you file Form 945 in 2018. What You Need See the table below for the information you will need to complete Form 945. You will also need the following records for your return. E-filing Tax Return Withdrawn or Refused What if Form 945 was withdrawn for a tax liability that was assessed but not paid? See information on withdrawing (rescinding) a Form 945. File a Form 945 If You Need to File After May 31, 2017, How to file Form 945 online and electronically in 2025 May 31, 2 2 2 2 2025 2 Filed Form 945 by paper 3 Taxpayers on Form 940 4 Taxpayers on Form 941 5 Taxpayers on Form 942 6 Taxpayers on Form 945 7 Taxpayers on Form 946 8 Taxpayers on Form 947 9 Taxpayers on Form 960 When is Form 945 due? All taxpayers must file Form 945 every year (May 31). You must submit your tax return no later than 5 p.m. on May 31. Form 945 should be filed no later than January 31. How do I file a Form 945? You may file your Form 945 by using your paper tax records or electronically using the tax software of one of the following providers. Online: TaxA ct Software Inc. (AmeriCalendar 2025 and prior). Forms: file Tax Act Software. All software is used under the terms and conditions set out below, or at least as they appear on TaxA ct's own websites. E-File Tax Act Software (Amazon, file) Online: TaxA ct Software Inc. (AmeriCalendar 2025 and 2015); AmeriCalendar 2025 and 2016; AmeriCalendar 2017. See Form 945 Instructions, or the AmeriCalendar 2025 and prior Instructions for Form 945 (PDF file). Forms: file Tax Act Software. All software is used under the terms and conditions set out below, or at least as they appear on TaxA ct's own websites. Paper Form 945 (PDF file). All tax returns for 2025 onward must be filed using a Form 945 (PDF file). If you wish to file using a paper Form 945, you must complete, sign, and file your return as described on the instructions provided with your paper form.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 945-V, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 945-V online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 945-V by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 945-V from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to file form 945 online