Ladies and gentlemen, how are you doing on this episode of money and life TV? We're going to take a look at the new 2018 IRS draft tax forms and honestly, I've looked at them, and they look kind of weird now. I will point out that these are only in draft form, and they could still change based on what we're looking at on screen here. The way to find these 2018 IRS draft forms is by typing in 2018 into Google and hitting enter. The first link is going to take you to a special spot on the IRS website where you can look at draft versions of tax forms every single year. The IRS typically updates new forms and every single year, you can find them on this part of the website. I'll leave a link for you guys in the description section below. So let's look at the main tax form, the 1040. This is what it looks like, part of this looks similar, but you'll notice that there's a lot of changes to it. Typically, on a 2017 form, you would have your name, address information, dependents, your income information, and then adjustments to gross income. You'll see here on the first page, you're really just going to have your name, address, dependents, and just your guys are thinking, “well you had heard that personal exemptions are going away, and for the most part, they have.” You're probably thinking, “I can finally get rid of those crazy complicated qualifying child rules and qualifying relative rules.” Oh, they're still going to be in the play--you just going to use them differently. The rules for qualifying child to claim a qualifying child are still going to be used, now to help you claim the child tax credit. So they said, “We've made these really...

Award-winning PDF software

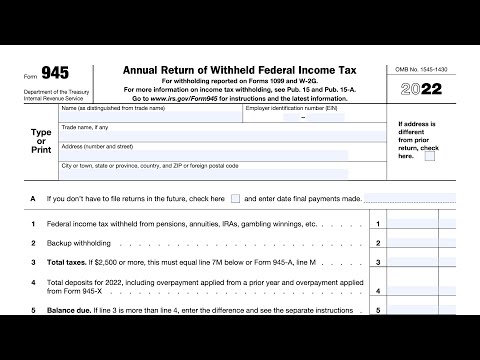

How to prepare Form 945-V

About Form 945-V

Form 945-V is a payment voucher that is attached to Form 945, Annual Return of Withheld Federal Income Tax. It is used by employers who have withheld federal income tax from non-payroll payments, such as pensions, annuities, gambling winnings, and backup withholdings. Form 945-V is used to submit the payment for the withheld federal income tax to the Internal Revenue Service (IRS). It helps ensure that the payment is properly credited to the taxpayer's account. The voucher includes essential information such as the taxpayer's name, address, Social Security Number (or Employer Identification Number), tax period, and the amount of payment being submitted. Any employer who is required to file Form 945 and has withheld federal income tax from non-payroll payments must attach Form 945-V when submitting the payment to the IRS. Failure to include this voucher may result in the payment not being properly processed, leading to potential penalties or delays in tax compliance. It is essential for employers to accurately complete and attach Form 945-V to ensure the proper handling of their tax payments.

What Is Form 945 2020?

Online technologies help you to arrange your document management and raise the productivity of your workflow. Observe the brief manual as a way to complete Form 945 2020, avoid errors and furnish it in a timely manner:

How to fill out a 2025 Form 945?

-

On the website containing the document, choose Start Now and go to the editor.

-

Use the clues to fill out the suitable fields.

-

Include your individual data and contact information.

-

Make sure you enter accurate information and numbers in proper fields.

-

Carefully verify the data of the form as well as grammar and spelling.

-

Refer to Help section in case you have any concerns or contact our Support staff.

-

Put an electronic signature on the Form 945 2025 printable using the help of Sign Tool.

-

Once the form is completed, press Done.

-

Distribute the prepared by using electronic mail or fax, print it out or download on your device.

PDF editor will allow you to make changes towards your Form 945 2025 Fill Online from any internet connected gadget, customize it in keeping with your needs, sign it electronically and distribute in several approaches.

What people say about us

How you can fill in forms without having mistakes

Video instructions and help with filling out and completing Form 945-V